Introducing OEV-Boosted Morpho Markets

A new mechanism to recycle liquidation incentives back to DeFi users. Built on Morpho, curated by Yearn Finance, powered by Api3.

The Problem with Liquidations in DeFi

Liquidations are a critical safeguard for lending protocols — ensuring that bad debt doesn't occur. But the way liquidations are handled today results in significant value leakage.

When a borrower becomes undercollateralized, liquidators are incentivized to act quickly by being offered a portion of the borrower's collateral in return for repaying their debt. These rewards are typically structured as a percentage of the position and scale with size, creating fierce competition the larger the position is.

Depending on the environment, this competition takes on different forms — but both lead to the same outcome: wasted value.

On Chains with Blockspace Auctions: Block Builders Take the Cut

On chains that support generalized blockspace auctions — like Ethereum mainnet — liquidators often bribe block builders to prioritize their transactions. The larger the liquidation, the more intense the competition — and in many cases, the entire incentive gets bid away through blockspace auctions. The liquidator walks away with little or nothing, while the block builder — who only plays a passive role — captures all the value.

This reveals a core misalignment:

Liquidators are willing to do the job for much less.

Block builders are capturing value simply because they control ordering, not because they add value.

On Chains Without Blockspace Auctions: Spam, Gas Wars, and Randomness

On chains without generalized blockspace auctions — including most rollups and many newer L1s — the dysfunction simply takes a different form. Without a structured way to compete, liquidators resort to spamming liquidate() transactions, hoping to land in the same block as the oracle update. One lucky participant gets the full reward. Everyone else wastes gas, congests the network, and gets nothing.

This is still a form of auction, just one that plays out through guesswork and inefficiency. There are no guarantees, no coordination, and no clarity — just infrastructure arms races and probabilistic outcomes.

This is a fundamental misalignment — and it’s where Oracle Extractable Value comes in.

OEV: Changing the Auction Layer

Api3’s OEV Network changes where the competition for liquidations happens — and who ultimately benefits.

Oracles play a unique role in liquidations: they provide the price data that makes them possible. In practice, this means that price updates enabling liquidations are significantly more valuable than regular updates — but most oracles treat them the same.

Api3 doesn’t. Our oracles are aware of the economic value they unlock, and we auction off the rights to a time-limited edge that guarantees the ability to liquidate. This creates a new coordination layer — one that moves the competition into the oracle layer itself.

Instead of spamming transactions or bribing block builders, liquidators bid for access to exclusive, real-time data. That access guarantees execution. It eliminates waste. And it allows protocols to capture the value that would otherwise be lost to extractive actors.

The value that gets reclaimed can then be routed back to the users of the protocol — creating a more aligned and self-sustaining incentive structure for lending markets.

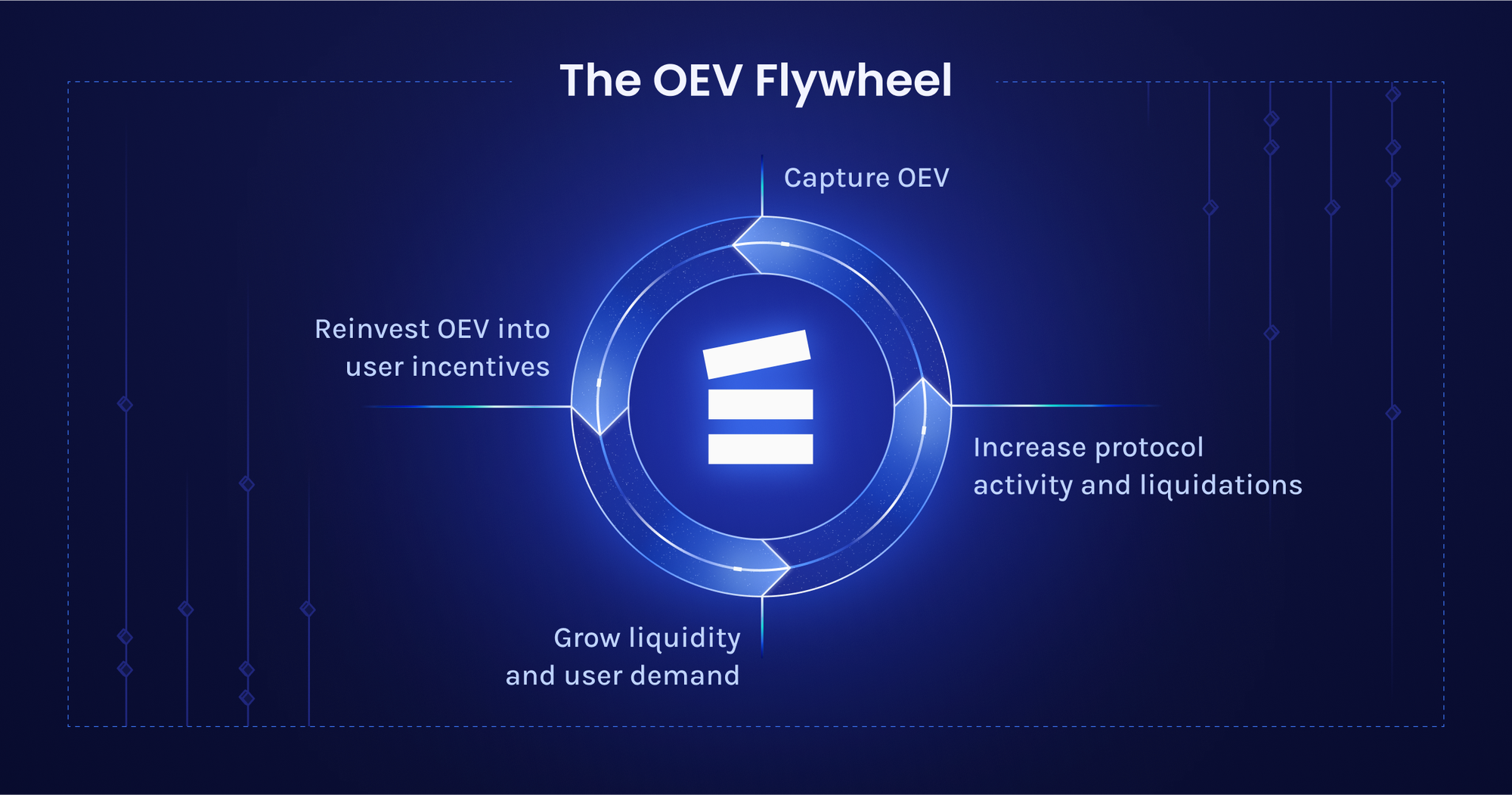

The OEV Flywheel

This dynamic forms a self-reinforcing loop: the OEV Flywheel.

By auctioning off liquidation-triggering oracle updates, protocols capture OEV that would otherwise leak to external actors. This recaptured value is then reinvested into user incentives — boosting protocol participation, increasing activity and liquidation events, and in turn generating more OEV. As liquidity and user demand grow, the cycle strengthens.

OEV-Boosted Morpho Markets

OEV-Boosted Morpho Markets are lending markets that integrate Api3’s Oracles to capture value from liquidations and return it to the users of the market — either to suppliers, borrowers, or both.

These markets are a direct implementation of the OEV Flywheel: value is captured at the oracle layer, recycled into user incentives, and used to grow liquidity and protocol activity — which, in turn, generates even more OEV to reinvest.

Built on Morpho’s efficient architecture, these markets maintain full composability and user experience, but introduce a novel revenue stream sourced from liquidation activity that would otherwise leak away to third-parties needlessly.

Degens are still going to lever up — that much won’t change. But now, instead of the value being lost, it can be redirected to benefit the other participants in the market.

Risk-taking behavior funds protocol-native incentives.

Launching with Yearn Finance

To bring these new market designs to life, we're collaborating with Yearn Finance, who will serve as the Curator of the first OEV-Boosted Vaults.

These vaults will exclusively allocate capital to OEV-Boosted Markets — enabling them to benefit directly from the value recaptured via the oracle-layer auctions.

By curating these vaults, Yearn plays a key role in guiding capital toward more sustainable and user-aligned lending infrastructure.

The First Market: wstETH/USDC

The first OEV-Boosted Market will be a high-demand, blue-chip pair: wstETH as collateral and USDC as the borrowable asset.

This pairing was chosen for three reasons:

- It’s one of the most active blue-chip pairs in DeFi.

- It has deep liquidity across the ecosystem.

- It accounts for more liquidation activity on Morpho than any other pair to date.

That makes it the ideal launchpad for demonstrating how OEV-based incentive models can reclaim and redistribute value at scale.

Rewards

To jumpstart participation and establish early momentum, this market will launch with USDC incentives distributed to suppliers and/or borrowers. These rewards will help bootstrap liquidity and usage during the initial phase.

As liquidations occur, value is captured at the oracle layer via Api3’s OEV auctions. The proceeds from these auctions will be distributed month over month via Merkl to participants in the OEV-Boosted Market — extending or even replacing the need for external incentives over time.

Conclusion

OEV-Boosted Morpho Markets mark a shift in how we think about incentives in DeFi. Instead of relying on inflationary token emissions or letting value slip away to infrastructure layers, they channel existing economic flows — like liquidation incentives — back to the users who make the market work.

By relocating competition from the blockspace to the oracle layer, Api3’s OEV Network turns a structural inefficiency into a sustainable incentive mechanism. Liquidators still compete — but users, not block builders, end up with the upside. Value stays where it's created. Incentives grow from protocol-native activity. And market participants — not middlemen — reap the rewards.

We're excited to launch this experiment with Yearn and Morpho. And we think it’s just the beginning.